The Daily Insight

Stay updated with the latest news and insights.

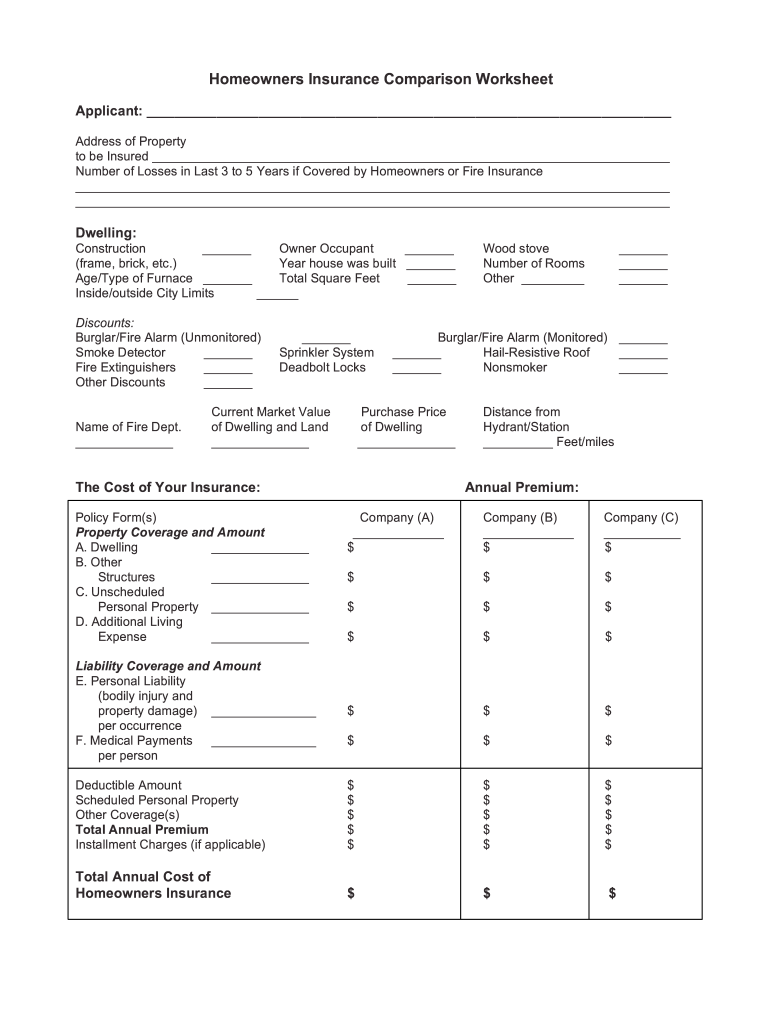

Insurance Showdown: Finding Your Perfect Policy Match

Discover the ultimate showdown in insurance! Find your perfect policy match today and secure your future with ease.

Top 5 Factors to Consider When Choosing Your Insurance Policy

When it comes to choosing the right insurance policy, there are several key factors you should consider to ensure that you are adequately protected. First and foremost, coverage options play a pivotal role in determining whether a policy fits your needs. Policies can vary widely in terms of what they cover, so be sure to review the specific coverage options available to you. Additionally, understanding the differentiation between premiums and deductibles is crucial. A lower premium may seem attractive, but it could lead to higher out-of-pocket expenses when it comes time to make a claim.

Another critical factor to consider is the financial stability of the insurance provider. It's important to select an insurer that has a strong financial foundation and a good reputation in the industry. Resources such as A.M. Best can provide insights into the financial health of various insurance companies. Lastly, consider the customer service provided by the insurer. Reading reviews and ratings on platforms like Consumer Reports can help you gauge how well they respond to claims and inquiries, ensuring that you will have the support you need when it matters most.

Understanding Different Types of Insurance: Which One is Right for You?

Insurance is an essential part of financial planning, providing peace of mind and protection against unexpected events. Understanding the different types of insurance available can help you make informed decisions about which policies suit your needs. Generally, insurance can be categorized into several key types, including health insurance, life insurance, auto insurance, and homeowners insurance. Each type serves a unique purpose, so it’s crucial to assess your personal situation and risk factors to determine which policies are right for you.

When considering which insurance policies you may need, evaluate your lifestyle, financial obligations, and potential risks. For instance, if you have dependents, life insurance might be essential to secure their financial future. On the other hand, if you're a homeowner, having adequate homeowners insurance can protect your investment and belongings. Ultimately, analyzing your specific circumstances will guide you in selecting the right types of insurance that align with your needs and budget.

Common Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, there are numerous myths that can mislead consumers and lead to poor decision-making. One common belief is that having insurance means that you won't have any out-of-pocket expenses. In reality, most insurance policies come with deductibles, coinsurance, or copayments that you must pay before your coverage kicks in. Understanding these terms can help you make more informed choices. For more details on this topic, you can visit the NAIC website.

Another prevalent myth is that you don’t need insurance if you’re healthy. Many people believe that they can skip insurance coverage because they are in good health. However, accidents and unexpected illnesses can happen to anyone at any time, making insurance a crucial safety net. In fact, having insurance can protect your financial future and provide peace of mind. To understand more about the importance of insurance, check out this article on Forbes.