The Daily Insight

Stay updated with the latest news and insights.

Whole Life Insurance: The Financial Safety Net You Didn't Know You Needed

Discover why whole life insurance is the ultimate financial safety net you've been missing—secure your future today!

Understanding Whole Life Insurance: Key Benefits and Features

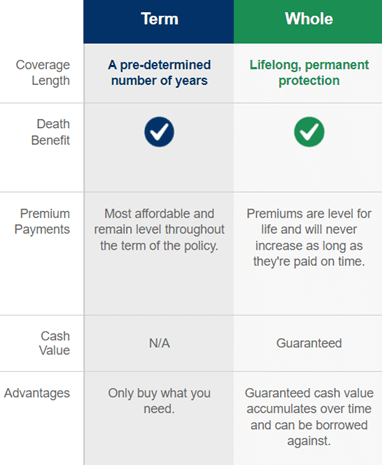

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. One of its primary benefits is the guaranteed cash value accumulation, which grows at a predetermined rate. This cash value can be borrowed against or withdrawn, providing policyholders with liquidity and additional financial options in times of need. Additionally, whole life insurance comes with a fixed premium, enabling individuals to budget effectively over their lifetime without worrying about premium increases as they age.

Moreover, whole life insurance offers death benefit protection that ensures financial security for beneficiaries upon the policyholder’s passing. This feature is crucial for those looking to leave a legacy or cover expenses such as mortgage debts, educational costs, or funeral expenditures. The peace of mind that comes with knowing loved ones will be financially secure is invaluable. Furthermore, since the policy accumulates cash value, it can also serve as a financial tool for tax-advantaged growth, adding another layer of benefit to this robust financial product.

Is Whole Life Insurance Right for You? Common Questions Answered

When considering whole life insurance, it's essential to evaluate your personal financial goals and needs. Whole life insurance provides lifelong coverage and accumulates cash value over time, making it distinct from term life insurance. This policy can be particularly beneficial for those looking for a stable investment in addition to life coverage. However, it often comes with higher premiums than term policies, so understanding your financial situation is crucial. Here are some common questions to consider:

- What are the long-term benefits of whole life insurance?

- How does the cash value growth work?

- Is it more expensive than other types of life insurance?

Another important aspect to contemplate is whether you have dependents or significant financial obligations. If you are financially stable and wish to leave behind a legacy for your family, then whole life insurance might be a suitable choice. It's also wise to assess your risk tolerance and investment strategy. According to financial experts, it's often recommended to diversify your investments instead of relying solely on insurance products. Ultimately, the decision should align with your overall financial plan and future objectives.

How Whole Life Insurance Can Serve as a Financial Safety Net

Whole life insurance serves as a vital financial safety net by providing not only coverage for your loved ones in the event of your passing but also a cash value component that can grow over time. This dual functionality can be a significant part of your overall financial strategy. The predictable premium payments and guaranteed death benefits ensure that your family is protected, while the cash value accumulation offers a source of funds that can be accessed during your lifetime.

Moreover, as the cash value of whole life insurance grows, it can serve as a low-risk investment option. Policyholders can borrow against this cash value, providing a financial cushion during emergencies or unexpected expenses. This accessibility makes it an attractive component of a retirement strategy, offering retirees additional liquidity and financial freedom. In essence, whole life insurance not only safeguards your family but also acts as a reliable financial resource, enhancing your overall peace of mind.