The Daily Insight

Stay updated with the latest news and insights.

Valuations in a Roller Coaster Market: Finding the Silver Lining

Discover how to uncover hidden opportunities in a volatile market. Find the silver lining in valuations and boost your investment strategy today!

Understanding Market Volatility: How to Navigate Valuations in a Roller Coaster Market

Understanding market volatility is crucial for investors looking to navigate the choppy waters of fluctuating valuations. Market volatility refers to the degree of variation in trading prices over time, and it can significantly impact investment decisions. When markets experience sudden swings, it's essential to analyze the underlying factors driving these changes. This includes economic indicators, geopolitical events, and investor sentiment. By honing in on these aspects, you can better position your portfolio to ride out the storms of a roller coaster market.

To effectively manage your investments during periods of volatility, consider adopting a diversified investment strategy. This involves spreading your investments across various asset classes, such as stocks, bonds, and real estate, to mitigate risk. Additionally, utilize technical analysis and market trends to identify potential entry and exit points. Remember, patience is key; resisting the urge to make impulsive decisions can often yield better long-term results. Stay informed, remain calm, and navigate your way through market fluctuations with confidence.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players can engage in competitive matches where they assume the role of either terrorists or counter-terrorists, executing various missions to achieve victory. The game's economy system has also given rise to a vibrant skin market recovery, where players buy, sell, and trade virtual weapon skins to customize their gameplay experience.

Identifying Opportunities: Key Metrics to Assess Valuations in Uncertain Times

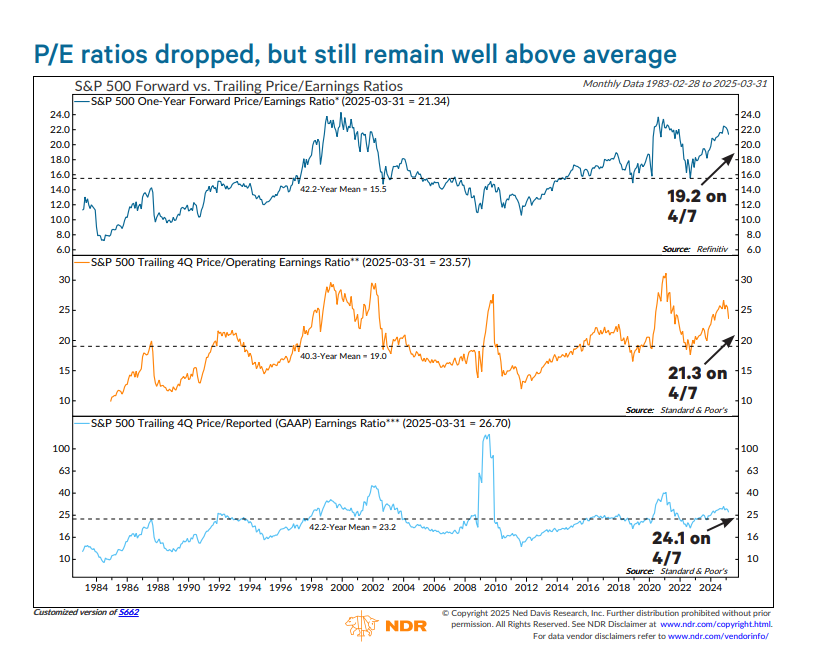

In uncertain times, understanding how to assess valuations is critical for identifying opportunities that may arise in the market. By focusing on key metrics, investors can make informed decisions that capitalize on potential growth. Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Dividend Yield are foundational metrics that serve as indicators of a company's financial health and market position. Additionally, evaluating operational metrics such as Cash Flow and Debt-to-Equity Ratio can provide deeper insights into the sustainability of a company during volatile periods.

Moreover, it is crucial to consider market sentiment and external factors that can influence valuations. For instance, investor sentiment driven by economic indicators or geopolitical events can significantly sway stock prices. Tracking these sentiments through social media analytics or news sentiment analysis can be advantageous. Furthermore, integrating qualitative assessments such as management quality and business model resilience can round out a more holistic approach to identifying opportunities amidst uncertainty. Remember, the key lies in blending both quantitative metrics and qualitative insights for a robust evaluation strategy.

Is There a Silver Lining? Strategies for Investing in a Fluctuating Market

Investing in a fluctuating market can be challenging, but understanding a few key strategies can help turn uncertainty into opportunity. The first step is to diversify your portfolio. By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can mitigate risks associated with market volatility. Additionally, consider incorporating index funds or ETFs as they offer built-in diversification and are typically more resilient during downturns. Regularly reviewing and rebalancing your portfolio, especially during market fluctuations, ensures that you remain aligned with your investment goals.

Another effective strategy is to adopt a long-term investment perspective. While it may be tempting to react to market fluctuations by buying or selling quickly, this often leads to poor decision-making and missed opportunities. Instead, focus on your long-term financial objectives and consider dollar-cost averaging, which involves consistently investing a fixed amount, regardless of market conditions. This approach can smooth out the impact of market volatility and potentially lower the average cost of your investments over time. Remember, every fluctuation presents a chance; stay informed and maintain a disciplined investment approach to navigate through uncertain waters.